How to solve the problem of customer communication and business handling of Internet bank? How to realize and undertake pre-sale, sale and after-sale of Internet banks? How to provide personalized financial services for multi-channel users such as app, applet and PC?

With the development of Internet Finance and the continuous change of users' needs, with the vigorous development of e-commerce, Internet marketing, direct banking and remote banking, more and more new generation of young customers communicate and handle business with banks through Internet channels. Customer service center, as the contact point between banks and customers, undertakes the service links of pre-sale, sale, after-sale and other links of bank products. The importance of customer service center is increasingly prominent. With the rapid popularization of Internet finance, especially mobile Internet finance, the needs and channels of customer service center service objects are undergoing dramatic changes.

The diversity of communication methods and channel interfaces gives the customer service center as a window department the inherent advantages of service experience, value-added services, marketing management, data analysis and value feedback. For customers, the convenience of using e-channel systems such as online banking, mobile banking, wechat Banking Based on the Internet platform greatly eliminates the information and transaction costs of bank products or services. As for the bank, the multi-channel integrated customer service center has broadened its service channel and marketing channel. In addition to strengthening the relationship maintenance with customers, various statistical data and historical data management functions are also conducive to the bank to better control the real-time market dynamics of products and services, to achieve the marketing purpose of timely regulation, improvement of services and transformation of visitors into customers.

After 60 years of development, AI technology has achieved breakthroughs in some specific business scenarios including customer service. The accuracy of technology application meets the requirements of large-scale commercial application, and begins to enter the practical application stage in some specific fields. Based on this, 2016 is also known as the first year of robots.

China's customer center industry, which started from "Telecom 97 project", has experienced 20 years of rapid growth, and has experienced the development path from call center to contact center to complete customer center. The operation is increasingly large-scale, precise, multi-channel, intelligent and universal. With the integration of voice, text and multimedia channels, the collaboration of artificial and intelligent services, and the integration of physical and digital channels; with the advent of the era of customer concept and humanity as the center, the customer center is moving from one side of the enterprise value chain to the center of value transmission, playing the core role of customer experience creation together with the application of new technology products.

The continuous innovation of consumer connection technology, contact technology and experience technology is profoundly changing the customer service industry. With the arrival of a new era of human-computer intelligence, deep learning, cognitive computing, service robots, augmented reality space are constantly changing the way, ability and experience of customer interaction, so as to impact the existing operation mode of customer center. The concept of sharing economy, blockchain technology and so on will even bring a greater revolution to the service and management paradigm.

Love customer service intelligent customer service platform is based on 17 years of knowledge accumulation in government, insurance, finance and other industries, relying on the world's leading intelligent robot research and Development Center (China Science and technology union Artificial Intelligence Research Institute, Tsinghua University speech language center, Harbin University of technology intelligent technology and natural speech center, Peking University Computational Linguistics Research Institute), production and learning It is the first choice of intelligent customer service system in the era of new media in specific fields such as banking, government and insurance.

Baixin bank is the first Internet direct bank in China that adopts the operation mode of independent legal person. CITIC Bank and Baidu company work together to provide financial products and banking services for individual and enterprise customers through Internet channels across the limitations of time and region, and open a new financial development mode of "Finance + Internet". The purpose of this intelligent customer service project is to follow the business strategy and it strategy of Baixin bank, and choose the intelligent customer service system with reliability, flexibility and security based on big data platform.

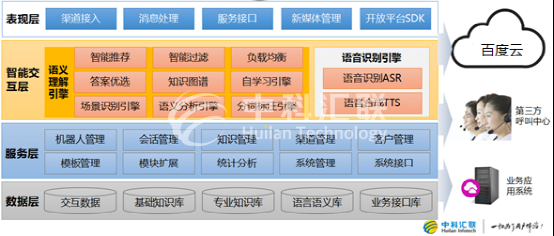

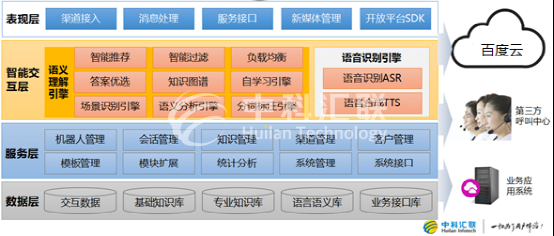

The intelligent customer service system constructed in this project is oriented to the business of Baixin bank. Based on the concept of "customer-centric" and data-driven, it system architecture of service-oriented, distributed and IOE free is adopted to receive in real time or in batch, so as to comprehensively improve the comprehensive service level of Baixin bank. System software products include semantic analysis subsystem, machine self-learning platform, knowledge base, work order system, human / online customer service, call center integration and customized development.

The project is divided into two construction objectives:

1. Open as planned. The goal of building an open business system for Internet innovation business is to build an intelligent customer service system based on the characteristics of the Internet banking business of Baixin and the big data platform system of Baixin under the guidance of the overall it planning scheme. According to the characteristic business requirements of Baixin, complete the system differentiation transformation, and cooperate with Baixin bank to realize the online of internal beta within 4 months, and complete the goal of opening business to the outside within 6 months.

2. Meet the customer service needs of all lines in the bank, including but not limited to the customer service needs of wealth management business department, inclusive finance business department, platform finance business department, payment innovation development department, operation support department, information technology department and other lines / departments.

The intelligence of the system is shown in the following aspects:

Semantic understanding: different from search technology, the system can accurately understand the semantics of Chinese sentences through intelligent word segmentation, part of speech tagging and other technologies;

Anaphora resolution: can accurately identify the content of pronoun's anaphora;

Ellipsis recovery: according to the content of context dialogue, intelligent understanding of sentence meaning is lack of sentence backbone;

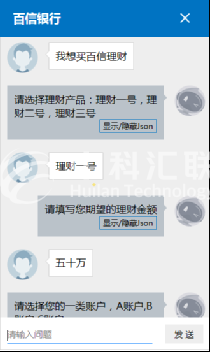

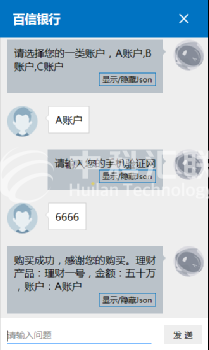

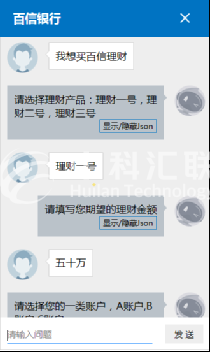

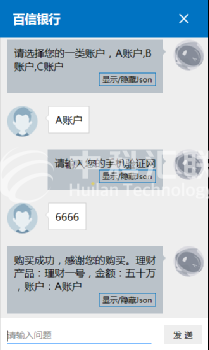

Multi round dialogue: the robot realizes multi round dialogue through intelligent rhetorical questions, and gradually reduces the business scope;

Semantic inversion: able to accurately understand the expression meaning of sentences with reversed word order;

Modal particles: robots can accurately understand the colloquial meaning of sentences containing modal particles;

Synonyms: for the same problem described by different synonyms and synonyms, robots can accurately identify and understand the essence of the problem;

Supervised learning: for problems not understood, robots can gradually improve the knowledge base of intelligent robots through supervised learning to form a strong intelligent robot brain;

Human machine transfer: the system intelligently understands the user's problems, and realizes the intelligent transfer from robot customer service to artificial customer service according to the user's conversation sentence semantics.

The comprehensive system is mainly shown in the following aspects:

Comprehensive access channel: the system has completed the standardized access of web, wechat, app and other channels, providing a complete channel access scheme without secondary development.

Comprehensive customer service system: the intelligent customer service system, which is composed of intelligent robot customer service + artificial customer service + work order, is adopted to comprehensively solve the user's consultation problems in various ways. The intelligent robot automatically solves more than 80% of the consultation problems. The problems that the robot cannot solve are transferred to the artificial customer service, and the problems that the artificial customer service cannot solve are transferred to the work order system. At the same time, the system provides a variety of transfer schemes for robot and human customer service to maximize service quality and service effect.

Comprehensive knowledge coverage: on the one hand, the system supports different units to manage their own knowledge base independently; on the other hand, the system supports knowledge learning. In the process of system operation and maintenance, the knowledge base comprehensively covers all problems through incremental and supervised learning.

Monday to Friday 9:00-18:00

Monday to Friday 9:00-18:00 Customer Service Email

Customer Service Email Online Consulting

Online Consulting